Age Limitation On Child Tax Credit. The child tax credit is a nonrefundable tax credit for each qualifying child you claim on your return, worth up to $1,000 per qualifying child. Spouses and other dependents don't have an age requirement, but irs rules say they must.

The child tax credit (ctc) was first enacted in 1997 and has been increased several times since then.

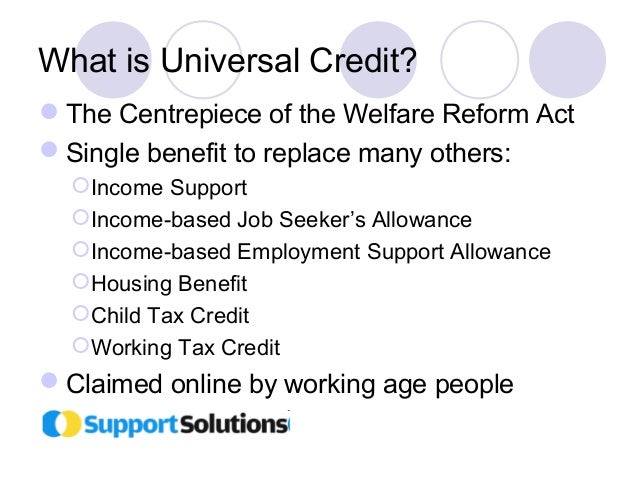

You cannot receive any excess credit as a refund. You get money for child tax credit is being replaced by universal credit. The 2020 and 2021 child tax credit can reduce tax liability by $2,000 per child, amounting to a cash refund of $1,400 each. (a) the credit which would be allowed under this section without regard to this subsection and the limitation under section 26(a).

Being able to find home decorating ideas is a goody but having access to free home decorating ideas can be a real gift. Good news, one can find free home decorating ideas open to you. Often when you decide up a magazine, perhaps while waiting for the doctor's office, something in the house decorating section catches your eye. Relaying pointers for home improvements, this website is offering you free Age Limitation On Child Tax Credit ideas. An excellent way to obtain information regarding home décor and decorating is actually a catalog from major stores which include Sears, Zellers or Ikea. Advertising their items, they'll use illustrations of fully decorated rooms. Browsing catalogs like these you may see many free home decorating ideas.

إرسال تعليق