Child Tax Credit Form 2018 Irs Schedule 4 Form. Is irs schedule 4 discontinued? What if i receive another tax form after i've filed my return?

The child tax credit is a significant tax credit for those with qualified dependent children under age 17 (more on qualifications in a bit).

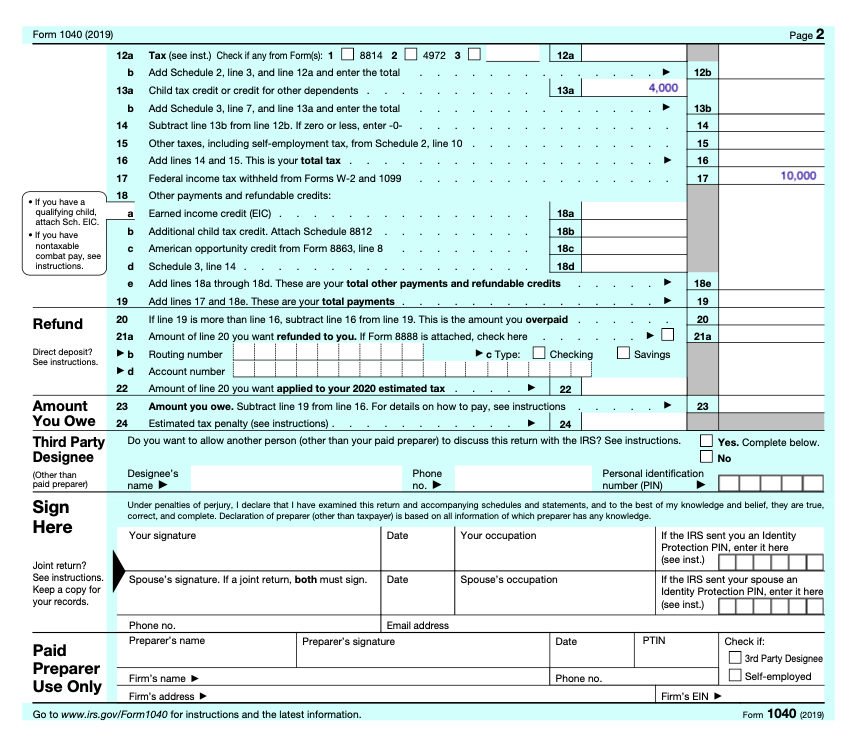

Tool lets you check the status of your refund through the irs website or the irs2go mobile app. Figure the amount of any credits you are claiming on schedule 3, lines 1 through 4; Use schedule a (form 1040) to figure itemized deductions, which include a part of medical and dental expenses and. Use schedule a (form 1040) to figure your itemized deductions.

Being able to find home decorating ideas is a delicacy but having having access to free home decorating ideas is often a real gift. Fantastic news, one can find free home decorating ideas designed to you. Often when you decide up a manuscript, perhaps while waiting along at the doctor's office, something at your home decorating section catches your eye. Relaying tips and techniques for home improvements, this website offers you free Child Tax Credit Form 2018 Irs Schedule 4 Form ideas. A fun approach of obtaining information regarding home décor and decorating is definitely a catalog from major stores such as Sears, Zellers or Ikea. Advertising a few, they prefer illustrations of fully decorated rooms. Browsing catalogs honestly there are many free home decorating ideas.

إرسال تعليق