What Is The Child Tax Credit 2020 Calculator Tax. Dependent status, 5 xmodified adjusted gross income (magi): For children born during the tax year, the child must have lived with you for at least half of the remaining tax year.

There are many ways to qualify for this valuable tax credit and checking eligibility for a qualifying child is the first step.

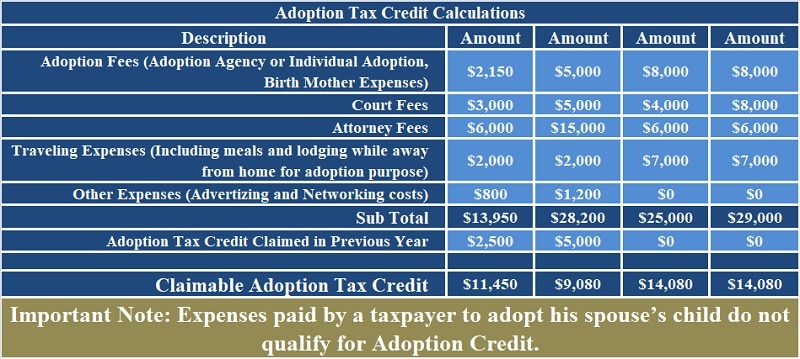

The line items that are to be completed are: 2020 standard deduction amounts increased. There are many ways to qualify for this valuable tax credit and checking eligibility for a qualifying child is the first step. A tax credit is a benefit given to eligible taxpayers to help reduce their tax liabilities.

Being capable of finding home decorating ideas is a delicacy but having authority to access free home decorating ideas is known as a real gift. Fantastic news, you will find free home decorating ideas available to you. Often when you decide on up a manuscript, perhaps while waiting in the doctor's office, something in your own home decorating section catches your eye. Relaying tips for home improvements, this website is offering you free What Is The Child Tax Credit 2020 Calculator Tax ideas. Another great method of obtaining information regarding home décor and decorating is definitely a catalog from major stores that include Sears, Zellers or Ikea. Advertising some, they stick to illustrations of fully decorated rooms. Browsing catalogs such as these you may see many free home decorating ideas.

Post a Comment