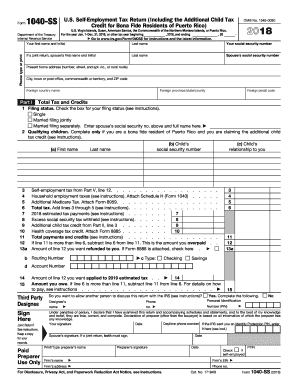

How To Fill Out A Child Tax Credit Form 2019 1040A Tax. The child tax credit is a refundable tax credit worth up to $2,000 per qualifying child and $500 per qualifying dependent. How to fill out irs form 1040 for 2019.

For your 2018 taxes, which you file in early 2019, you will use this.

Credit karma tax® can help you determine which additional forms you need to complete based on the deductions and credits. There's a big difference between tax deductions and tax credits. Schedule 8812, additional child tax credit, is the outputted form that the efile tax app will generate when you. How to fill out and sign form 1040 online?

Being able to find home decorating ideas is a delicacy but having permission to access free home decorating ideas is usually a real gift. Best part, you can find free home decorating ideas offered to you. Often when you select up a magazine, perhaps while waiting with the doctor's office, something in your own home decorating section catches your eye. Relaying pointers for home improvements, this website offers you free How To Fill Out A Child Tax Credit Form 2019 1040A Tax ideas. Another new source of information regarding home décor and decorating is often a catalog from major stores which include Sears, Zellers or Ikea. Advertising their products, they choose illustrations of fully decorated rooms. Browsing catalogs honest safe music downloads you can find many free home decorating ideas.

Post a Comment